Some Known Questions About Transaction Advisory Services.

Wiki Article

A Biased View of Transaction Advisory Services

Table of ContentsGetting My Transaction Advisory Services To WorkTransaction Advisory Services Fundamentals ExplainedExcitement About Transaction Advisory ServicesThe 9-Minute Rule for Transaction Advisory ServicesThe Buzz on Transaction Advisory Services

This action makes certain the service looks its ideal to potential buyers. Getting the organization's worth right is critical for a successful sale.Purchase advisors action in to aid by getting all the required info organized, responding to inquiries from buyers, and organizing sees to the business's area. This builds count on with purchasers and maintains the sale relocating along. Obtaining the very best terms is key. Transaction consultants utilize their competence to assist local business owner manage challenging arrangements, meet purchaser expectations, and structure offers that match the proprietor's objectives.

Fulfilling legal regulations is critical in any type of business sale. They help business proprietors in planning for their following actions, whether it's retired life, beginning a new endeavor, or handling their newfound wide range.

Deal consultants bring a wealth of experience and knowledge, making certain that every aspect of the sale is handled properly. Through calculated preparation, evaluation, and negotiation, TAS aids local business owner achieve the highest feasible list price. By guaranteeing lawful and regulatory compliance and managing due persistance along with other offer employee, purchase experts lessen possible risks and responsibilities.

The smart Trick of Transaction Advisory Services That Nobody is Discussing

By contrast, Big 4 TS groups: Work with (e.g., when a possible customer is carrying out due diligence, or when a bargain is shutting and the buyer requires to integrate the company and re-value the vendor's Equilibrium Sheet). Are with fees that are not connected to the offer closing efficiently. Make fees per engagement somewhere in the, which is much less than what financial investment banks gain even on "tiny offers" (but the collection probability is likewise a lot greater).

, but they'll focus extra on audit and evaluation and much less on subjects like LBO modeling., and "accountant just" subjects like test balances and just how to stroll via events using debits and credit histories rather than financial declaration modifications.

The smart Trick of Transaction Advisory Services That Nobody is Talking About

Specialists in the TS/ FDD groups might additionally speak with monitoring about everything above, and they'll create a detailed report with their findings at the browse around these guys end of the procedure.The hierarchy in Transaction Services differs a bit from the ones in investment banking and private equity careers, and the basic form resembles this: The entry-level duty, where you do a great deal of data and financial analysis (2 years for a promo from below). The next degree up; comparable job, yet you obtain the even more fascinating bits (3 years for a promotion).

Particularly, it's tough to get advertised beyond the Supervisor level since couple of individuals leave the work at that phase, and you need to begin showing proof of your ability to produce income to advancement. Let's begin with the hours and way of life considering that those are less complicated to describe:. There are occasional late evenings and weekend job, however absolutely nothing like the agitated nature of investment banking.

There are cost-of-living modifications, so anticipate lower payment if you remain in a more affordable area outside major economic facilities. this post For all settings other than Companion, the base pay consists of the bulk of the total payment; the year-end benefit could be a max of 30% of your base pay. Usually, the best means to increase your profits is to change to a various company and negotiate for a higher salary and bonus offer

Transaction Advisory Services Can Be Fun For Everyone

You could get involved in business development, but financial investment financial gets harder at this phase since you'll be over-qualified for Analyst roles. Company finance is still an option. At this stage, you should just stay and make a run for a Partner-level role. If you intend to leave, maybe relocate to a client and perform their assessments and due persistance in-house.The major trouble is that because: You generally require to sign up with one more Huge 4 group, such as audit, and job there for a few years and afterwards relocate right into TS, work there for a few years and after that relocate into IB. And there's still no guarantee of winning this IB role since it relies on your area, clients, and the hiring market at the time.

Longer-term, there is additionally some danger of and since evaluating a company's historic monetary details is not specifically brain surgery. Yes, humans will certainly constantly need to be involved, yet with more advanced modern technology, lower headcounts can possibly sustain customer engagements. That stated, the Purchase Providers team beats audit in regards to pay, work, and leave chances.

If you liked this short article, you could be why not find out more curious about reading.

Facts About Transaction Advisory Services Revealed

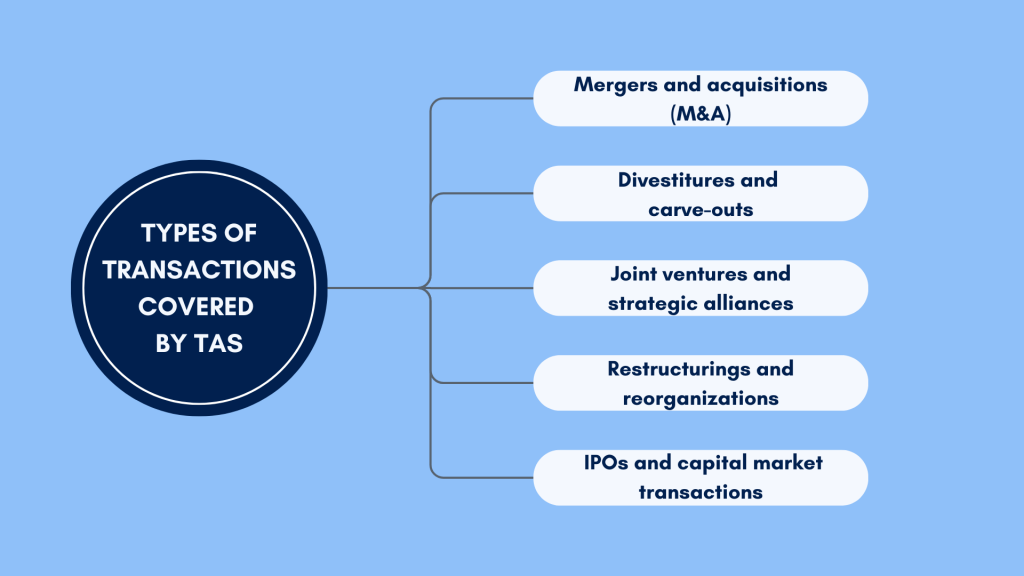

Develop advanced monetary structures that help in establishing the real market worth of a company. Give advising job in relationship to organization evaluation to aid in negotiating and rates frameworks. Describe one of the most ideal type of the offer and the type of consideration to employ (cash, stock, gain out, and others).

Perform combination planning to identify the process, system, and organizational adjustments that might be called for after the offer. Set guidelines for incorporating departments, technologies, and business procedures.

Assess the potential customer base, market verticals, and sales cycle. The functional due persistance provides essential understandings into the functioning of the company to be obtained worrying risk assessment and worth production.

Report this wiki page